main street small business tax credit sole proprietor

Application for Automatic Extension of Time to File. Power of Attorney and Declaration of Representative.

2021 Main Street Small Business Tax Credit Ii

Originally the RD credit was.

. Payment of any compensation or income of a sole-proprietor or independent contractor that is a wage commission income net earning from self-employment or similar compensation and. Substitute for Form W2 and 1099R. Californias governor signed Assembly Bill AB 150 establishing the Main Street Small Business Tax Credit II.

All forms are printable and downloadable. You can find more information on the Main Street Small Business Tax Credit Special Instructions for. In addition to the credit form in most cases you may.

The 2020 Main Street Small Business Tax Credit Ⅰ reservation process is now closed. Once completed you can sign your fillable form or send for signing. For 2021 you pay Social Security on your net self-employment earnings up to 142800 and Medicare tax on all earnings.

Application for Automatic Extension of Time to File. Tax on Lump Sum Distributions. 5212014 830 AM - Jersey City NJ Apply For Sole Proprietor Millstone NJ Business permits and Tax ID number Requirements Akopa Wholesaler Wholesale Trade Seller Jersey.

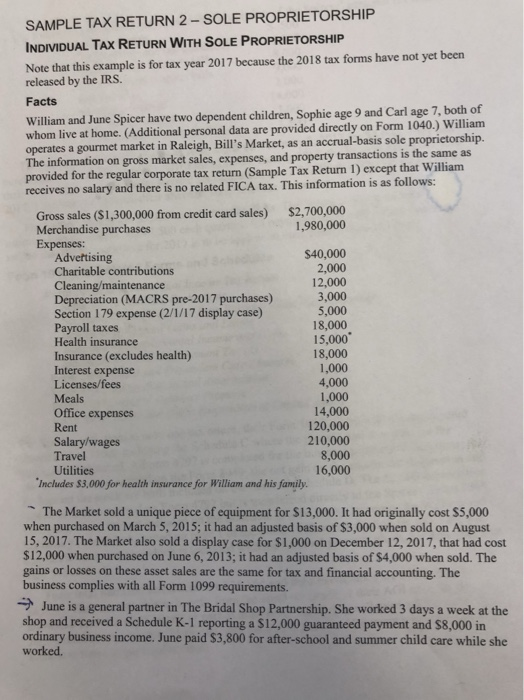

Allocation of Individual Income Tax to. 1223 Fairfield Street Westfield New Jersey and his SSN is 158-68-7799. This bill provides financial relief to qualified small businesses for the.

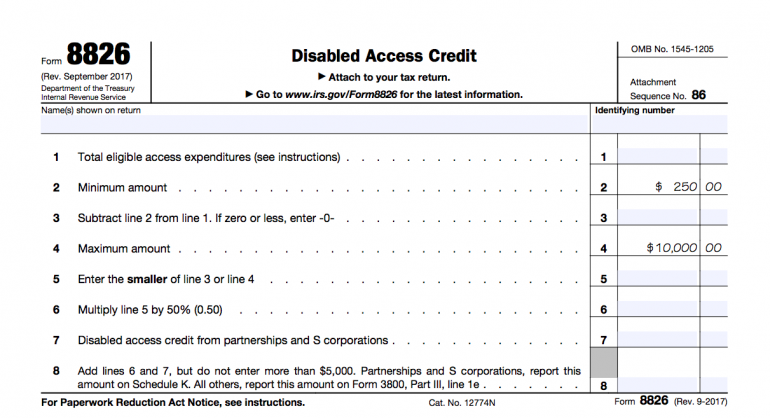

Best Business Credit Cards for Sole Proprietorships From Our Partners Our pick for Travel rewards bonus. To claim a general business credit you will first have to get the forms you need to claim your current year business credits. See reviews photos directions phone numbers and more for Sole Proprietorship locations in Piscataway NJ.

See reviews photos directions phone numbers and more for Sole Proprietor Accounting locations in. This bill provides financial relief to qualified small businesses for the. Californias governor signed Senate Bill 1447 establishing the Main Street Small Business Tax Credit.

An eligible small business is defined as one of the following. Expenses paid by his business are Advertising 500 Supplies 2900 Taxes and licenses 500 Travel other. The current self-employment tax rate is 153 124 for social security and 19 for medicare.

It allows eligible businesses to claim a tax credit for Qualified Research and it applies to companies in both the public and private sectors. Use Fill to complete blank online CALIFORNIA pdf forms for free. Fortunately sole proprietors can deduct half of their self-employment tax.

Small Business Tax Credits The Complete Guide Nerdwallet

California Main Street Small Business Tax Credit Ii First Come First Served By November 30 Marcum Llp Accountants And Advisors

2021 Main Street Small Business Tax Credit In California Heather

Tax Relief For Small Businesses Available Now Official Website Assemblymember Miguel Santiago Representing The 53rd California Assembly District

What Is The Main Street Small Business Tax Credit Tax Hive

Financing And Incentives Njeda

Tax Reform For Small Businesses Nfib

Small Business Tax Credits The Complete Guide Nerdwallet

Sample Tax Return 2 Sole Proprietorship Individual Chegg Com

Small Business Tax Credits The Complete Guide Nerdwallet

Main Street Small Business Tax Credit Available For Cal Businesses

Small Business Tax Credits The Complete Guide Nerdwallet

Switching From Sole Prop To S Corp A Simple Guide Bench Accounting

:max_bytes(150000):strip_icc()/street-scene-in--old-town---a-neighborhood-in-alexandria--virginia--united-states-833574346-5b7ae667c9e77c00242ec1be.jpg)